Decarbonization Planning Guide

Develop Your Decarbonization Plan

Build Your Capital Plan

Key steps and considerations to capital planning for decarbonization.

Capital planning is equally as important as the technical aspects of decarbonization. Preparing for investments over time, accurately estimating costs, strategizing sources of funding, and assessing value streams are all critical for success.

The capital plan should match the duration of your implementation plan. This could be over the course of a few years if you’re planning to decarbonize all at once, or it could be upwards of 10 to 20 years if you’ll be decarbonizing over time. For multi-year plans, focus on detailed actions within the near term, and regularly revisit your assumptions as you progress into longer timeframes.

Key Steps

- Conduct an internal review of your finances and determine operational budgets, potential reserves, and revenue streams for capital improvements.

- Document any planned renovations and other significant changes to operating plans over the next 5 to 10 years.

- Assess annual business-as-usual operational expenses such as utility bills, maintenance budget, and planned replacement of equipment. See Section: Business-as-Usual

- Identify potential investment triggers and the timeline for each of them:

- Refinancing or recapitalization

- Major tenant expirations

- Planned refreshes or renovations

- Needed equipment and system replacements and upgrades identified within the building’s capital needs assessment

- Establish a timeframe for planning and analysis based on your needs and goals to decarbonize.

- Talk to your team about selecting the right methodology for you to conduct long term financial comparisons of options such as life cycle cost. The methodology should reflect your current approaches to considering other types of investments in the building.

- Establish costs for new equipment and changes in utility bills and maintenance based on initial estimates. Refine these values throughout design and construction procurement.

- Investigate specialized green financing sources such as the Illinois Climate Bank or C-PACE.

- Identify potential grants and incentives from utility programs or other initiatives which could support investments. Consider the timeframes during which each incentive and funding opportunity is expected to be available.

- Outline cash flow needs to cover soft costs, contingencies, and construction payments along with potential debt sources.

- Review procurement steps, triggers, and timelines against the investment plan for the building developed from the capital needs assessment and required implementation payment schedules.

Timeline Components

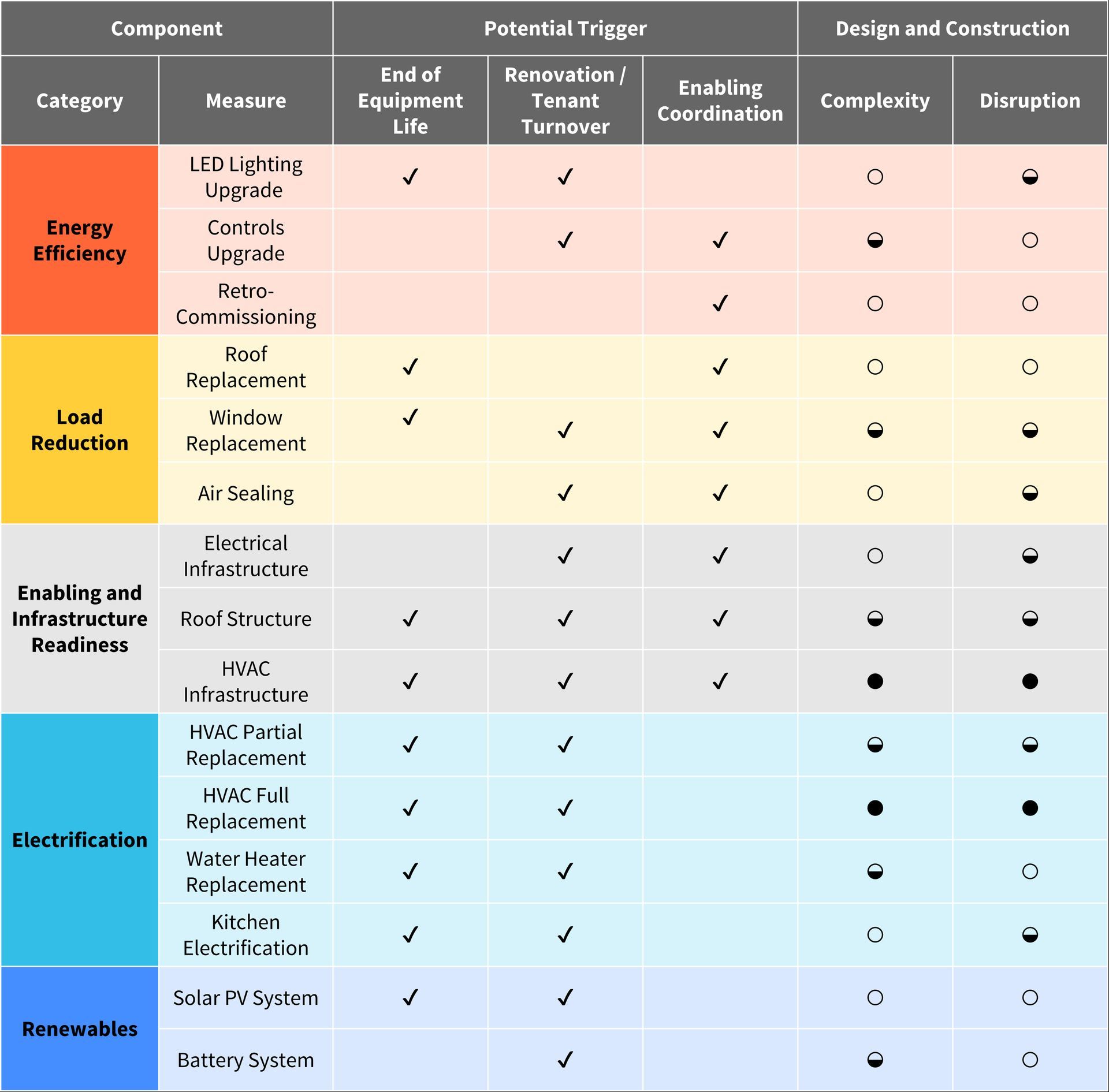

Identifying investment triggers for specific measures along with implementation considerations is important to establishing a realistic capital investment plan. Some measures may be able to be put in service at any point during the decarbonization plan’s timeline while the timing of others may be driven by a particular need or dependency. The level of complexity or extent of disruption will also differ across measures and steps within the plan. Some may be straightforward to implement, while others may require lengthy construction schedules and interrupt operations.

Financial Metrics: Payback vs. Life Cycle Costs Analysis

The financial metrics used to evaluate decarbonization investments may differ from conventional energy efficiency decision-making.

A common metric to evaluate energy efficiency investments is payback. This is the period of time over which the energy and operational cost savings enabled by an energy efficiency improvement will equal the initial incremental cost of the investment.

In decarbonization planning, the goals are more multi-faceted and complex than just simple cost reduction. Goals may include regulatory compliance, improved resiliency and risk reduction, and meeting sustainability targets. In some circumstances, decarbonization may not be the pathway that reduces utility costs the most, especially in the near term. For this reason, we recommend that decarbonization decisions be driven by life cycle cost analysis instead of simple payback.

Life cycle costs analysis (LCCA) can help owners look at investment tradeoffs over an extended timeline. Often this timeline would be based on the time it may take to complete the decarbonization plan, which could range between five and 25 years.

During this timeframe a business-as-usual case should establish the baseline for comparison. This should include utility costs and escalation, planned retrofits, initial costs to replace of aging equipment, maintenance expenditures, and possible incentives at a minimum. The proposed case should include changes in utility costs, expenditure on new equipment and maintenance, and any incentives or grants. Additional considerations could include finance charges, residual values, or monetary benefits from additional value adds.

See the following sections for more information on

value proposition and

establishing a business-as-usual case for comparison.

Utility Bill Impacts

Impacts on your utility bills will be a key driver in assessing potential pathway options for decarbonization. Depending on initial conditions and the types of systems installed decarbonization can provide a return on investment. However, balancing upfront investments with on-going operational costs is a key component to an optimized solution.

Utility prices will likely experience some volatility across the period of your decarbonization plan. Monitoring and estimating utility escalation rates will be important. Ask your GHG emissions reduction team to perform a sensitivity analysis on both electric and gas utility costs.

As discussed within the

Electrification section of this guide, it will be important to consider both usage and demand charges within your cost analysis. When electrifying you may also be moved into a new rate class and structure. There also may be discounts on rates for electric heating depending on your building type. Lastly, incorporating technologies that support demand response could lower your charges for electricity.

Incentives and Financing

There are several sources of funding that can support you in implementing decarbonization measures. As the sources are often changing with new resources frequently becoming available monitor the Hub’s Funding and Financing for Commercial Buildings page.

When reviewing potential incentives, grants, and green financing sources note:

- Some funding may not be available until construction is completed. This is often the case with utility program incentives and grants. You should still reach out early in the planning process to engage with these resources.

- Some grants will be competitive requiring an application and some pre-design work to be completed. You can engage with your GHG emissions reduction partners to support you in completing the necessary prerequisites.

- There are multiple forms of green financing or energy savings performance contracts available. Conduct the necessary background research to find which resources are right for you and your project.

The DOE Better Buildings Solution Center has a

primer on commercial financing which can help you get started.